RAAH Projects supports procure and supply services to the Oil and Gas Industry. One of the role that RAAH has played is in supporting companies and operators who have speeded up and increased the oil productions, we support them in timely submission of project requirements including Electrical, Instrumentation, Safety, Lifting equipment, Mechanical equipment and more. We carry several reputed brands including (and put some brands here). Some of the projects we service include (put the name of the projects and clients).

For more than a century, oil and gas have been essential for the expansion and development of the world economy. Even though the industry is faced with numerous obstacles, including a global pandemic that nearly stopped demand and caused oil prices to go negative for the first time in early 2020 before a rebound, and a persistent need for greater environmental sustainability, they are still used to meet more than half of the world’s primary energy needs. For the foreseeable future, the sector will undoubtedly continue to play a significant part in the development of the world’s energy landscape. According to the traditional economic model of price determination in microeconomics, the global forces of supply and demand control oil prices. The state of the global macroeconomy has a significant impact on the oil demand. High oil prices often have a significant negative influence on global economic growth, according to the International Energy Agency.

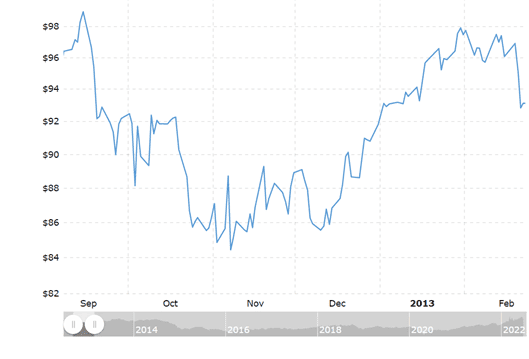

According to Michael Klare, professor of peace and world security studies at Hampshire College in Massachusetts, the usage of fossil fuels is fuelling violent conflicts all over the world. To make the case that the desire to control lucrative oil and gas resources is stoking long-standing historical tensions, Klare focuses on four regions: the South China Sea, the Crimea/Ukraine, South Sudan, and Iraq/Syria. He cautions that “in a world powered by fossil fuels, control of oil and gas soon after the battle, the Brent-indexed crude oil prices increased by 5% to over $98 per barrel by mid-March. The third-largest crude oil producer in the world is Russia. deposit is a crucial component of national power. The daily closing price of West Texas Intermediate (NYMEX) crude oil is displayed on an interactive chart over the past ten years. The amounts displayed are in US dollars. As of June 21, 2022, the price of WTI crude oil is $109.75 a barrel. A moving car powered by gasoline provides clear evidence of pollution scattering around the environment.

The above chart shows the graphical representation of the 10-year price chart of crude oil. Similarly, the crude oil price chart can be calculated to 12 monthly oil price charts so that the yearly variations can be calculated. Weekly transactions can be depicted from the 5-day oil price chart and long-term calculations.IEA agreed to release 60 million barrels equivalent from oil stockpiles amid Ukraine’s Turmoil. The majority of agriculture in Russia is produced tending to disruptions. A moving car with gasoline as an alternative source that releases toxic gases. According to Accenture, the oil and gas sector’s present supply chain issues jeopardize more than 20% of capital plans. As the epidemic and the conflict in Ukraine indicate, crises that can interfere with the operations of oil and gas corporations are inevitable.

According to some experts gain in the stock market and oil and gas market are correlated to each other. Governance of oil prices has been invaded by real business cycles with other factors affecting it as well. Afghanistan is also facing an increase in fuel prices due to the war effect. Considering America’s invasion accelerates oil and gas prices as the use of gasoline increases. In the USA rise in oil and gas prices is thought to increase inflation and the economic growth rate decrease. Due to inflation already oil prices are reached 110 $ per barrel. Aftermath survey by analyzing the world without oil like every fuel tank can be seen as dry and the roads, rails, and skies are virtually empty. Considering the highest price happened in July 2008 next is due to this war by 2022 highest reached is 123.7$. The solar and other renewable energy sector acts as an alternative career to the oil and gas energy sector.

Check out our Oilfield Safety Category